- (+91) 7399001009

- support@careertoday.info

Cost Accountant

A cost accountant specializes in navigating managerial decisions, stabilizing budgets and standards, identifying accountability for profit variance, assessing operational efficiency and effectiveness of production and service management. Responsibilities include designing and implementing effective management information and control systems, planning costing systems and methods, inventory control, incorporating mathematical models, investment analysis, project management, internal audit, cost audit, diagnosis in the case of sick industries, fund management, pricing planning interpreting information and data related to business activities and translating them in such a way as to guide the core management into taking the right decisions. The academic requirement is to pass the examination conducted by the Institute of Cost and Works Accountants of India (ICWAI).

Job Prospects

One could either serve in an industry or opt for government service. There is plenty of scope in the Banking and Insurance sectors. The government has made it mandatory for thirty- eight classes of companies to employ a Cost Accountant which offers numerous opportunities. There is always the option of practicing as an independent Consultant. A third option is to impart teaching at institutes or at universities. For a Cost Accountant, salary depends entirely on the organization.

Attributes

As for personal traits, the first requirement is that one needs to be a native numerate. Of course, academic abilities also top the list alongside. Other equally important requirements are an ability to communicate concisely, a keen business sense and the ability to negotiate. The job calls for a high sense of motivation, concentration and determination.

Eligibility

As ICWAI examinations are held in three stages Preliminary, Intermediate and Final. A candidate may appear for the Preliminary examination after passing the 10 + 2 examination. The students are tested in English, Mathematics, and General knowledge. The preliminary is waived in the case of Gazetted Officers, Post Graduates, qualified Engineers holding a degree and Graduates from other streams with 50% marks. They are generally allowed to register with the institute for the Intermediate examination. Regional councils and other institute recognized by the Directorate of Studies of the ICWAI conduct these classes. Examinations are held twice a year. The Cost and Work Accountancy course may be completed over a period of two or three years. It is generally considered to be easier than the Chartered Accountancy course.

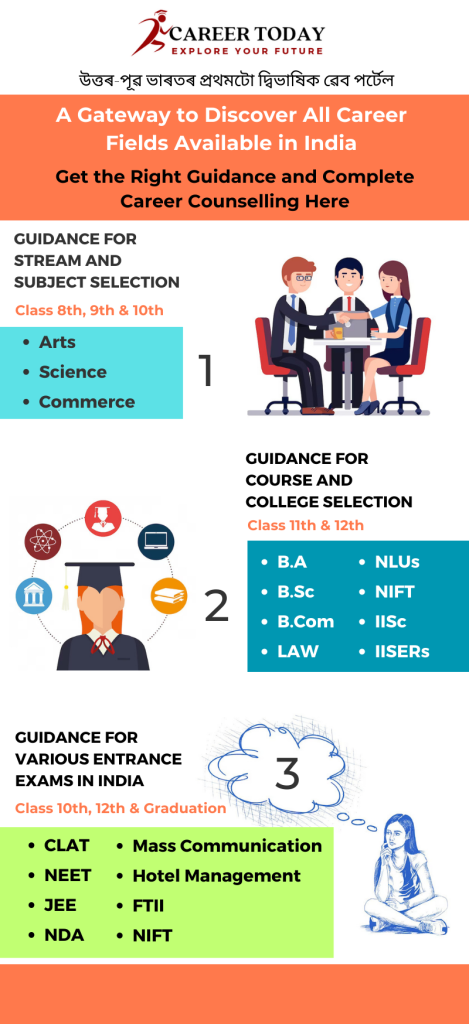

Career Today will help you discover more about your career path and identify the exact courses you need to excel in your career.

Ask Your Career Queries